424 Banks gone, 718 ATMS gone: Enough is enough

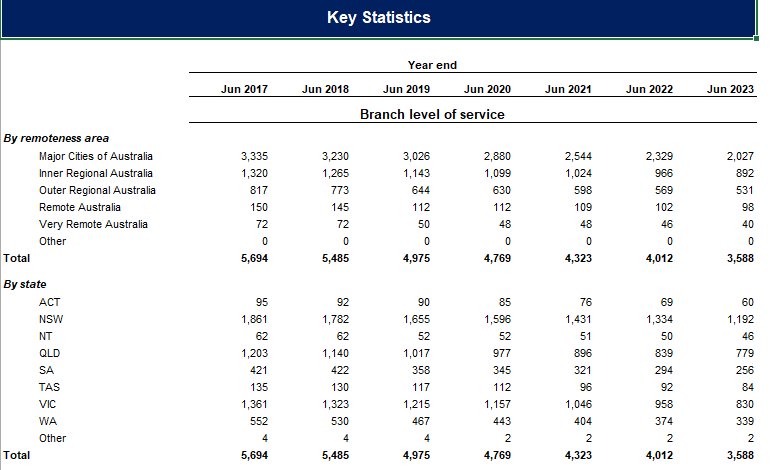

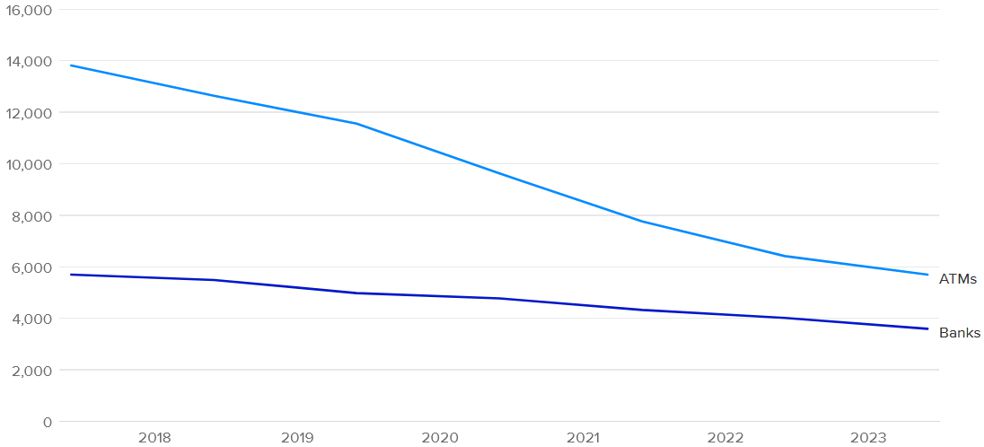

APRA has confirmed that Australia lost another 424 bank branches in the last 12 months.

Banks also closed or removed a further 718 bank-owned ATMs.

Big banks are continuing to close bank branches and ATMs, further restricting access to cash and full banking services, despite the continuing inquiry into bank branch closures by the senate’s Rural and Regional Affairs Committee and the treasury’s Modernising Payment Systems process.

Some banks made explicit promises to stop closing branches while the senate committee’s process was underway.

“Australians don’t want to lose access to cash or their right to choose cash to pay for essential goods and services,” said Jason Bryce, spokesperson for the Cash Welcome campaign.

Consumers and businesses need cash and banking for our local economies to thrive. Even people who don’t use cash every day need cash occasionally or when systems go offline. Many bank branches are being closed despite continuing heavy foot traffic and even growing numbers of customers.

“Banks enjoy a central place at the heart of our economy and money system. Banks need to serve their customers and ensure that all communities have ready access to cash.

DECLINING NUMBER OF BANK BRANCHES & ATMS

“Australians don’t want a cashless society. If I buy bottled water that doesn’t mean I want the water pipes to my home dismantled,” said Mr Bryce.

“The cash system is essential national economic infrastructure, that is now being dismantled and replaced by privately owned payment systems charging fees to users.”

More than 120,000 Australians have signed my petition calling for a cash and banking guarantee: change.org/BankingAndCashGuarantee. (Cash Welcome)